Not known Factual Statements About Investment Advisors

Table of ContentsThe Only Guide for Investment AdvisorsInvestment Advisors Things To Know Before You Get ThisInvestment Advisors Can Be Fun For AnyoneRumored Buzz on Investment AdvisorsThe Facts About Investment Advisors RevealedAbout Investment Advisors

The money can get you a quality strategy that can be created in a few hours as well as last you twenty years, with only a marginal demand for a monetary checkup with the planner periodically.

The definition of a fiduciary is an individual to whom property or power is turned over for the benefit of another. Basically, a fiduciary is an individual or organization that owes to one more the duties of great faith as well as count on. I think this is one of the most important expectation to have of your monetary advisor.

Unknown Facts About Investment Advisors

These two words are fiduciary and viability (investment advisors). The Fiduciary Requirement was created in 1940 as part of the Investment Advisors Act. This requirement, regulated by the SEC or state protections regulators, keeps that financial investment advisors are bound to a standard that requires them to put their customers' passions over their very own.

The requirement to disclose possible dispute of rate of interest is not as stringent a need as it is with a fiduciary. A financial investment for a customer only has to be suitable at the time of sale. The Fiduciary Requirement is the greater standard, as a consultant should do his/her best to make certain the financial investment guidance they are providing is used exact and also full information - investment advisors.

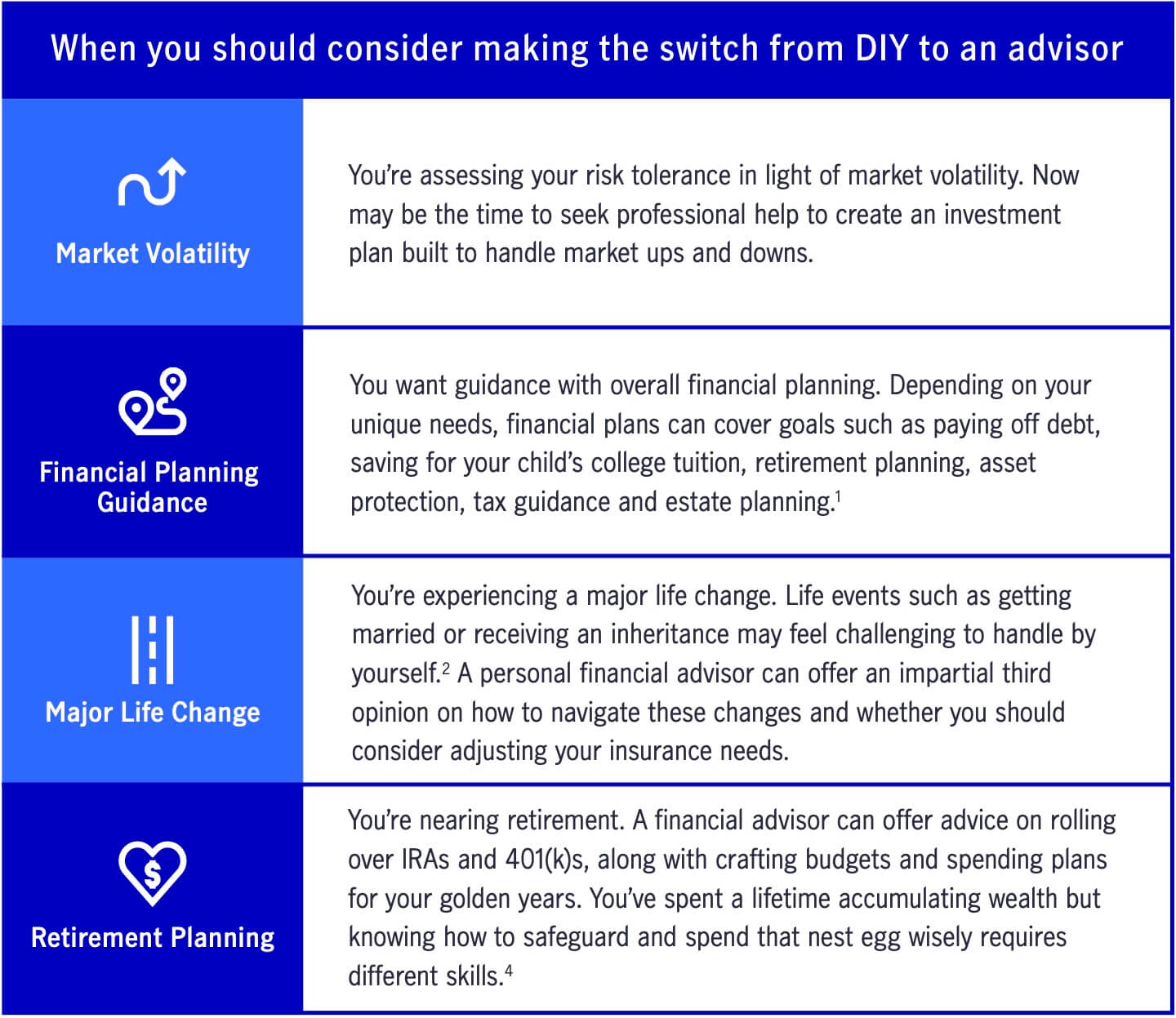

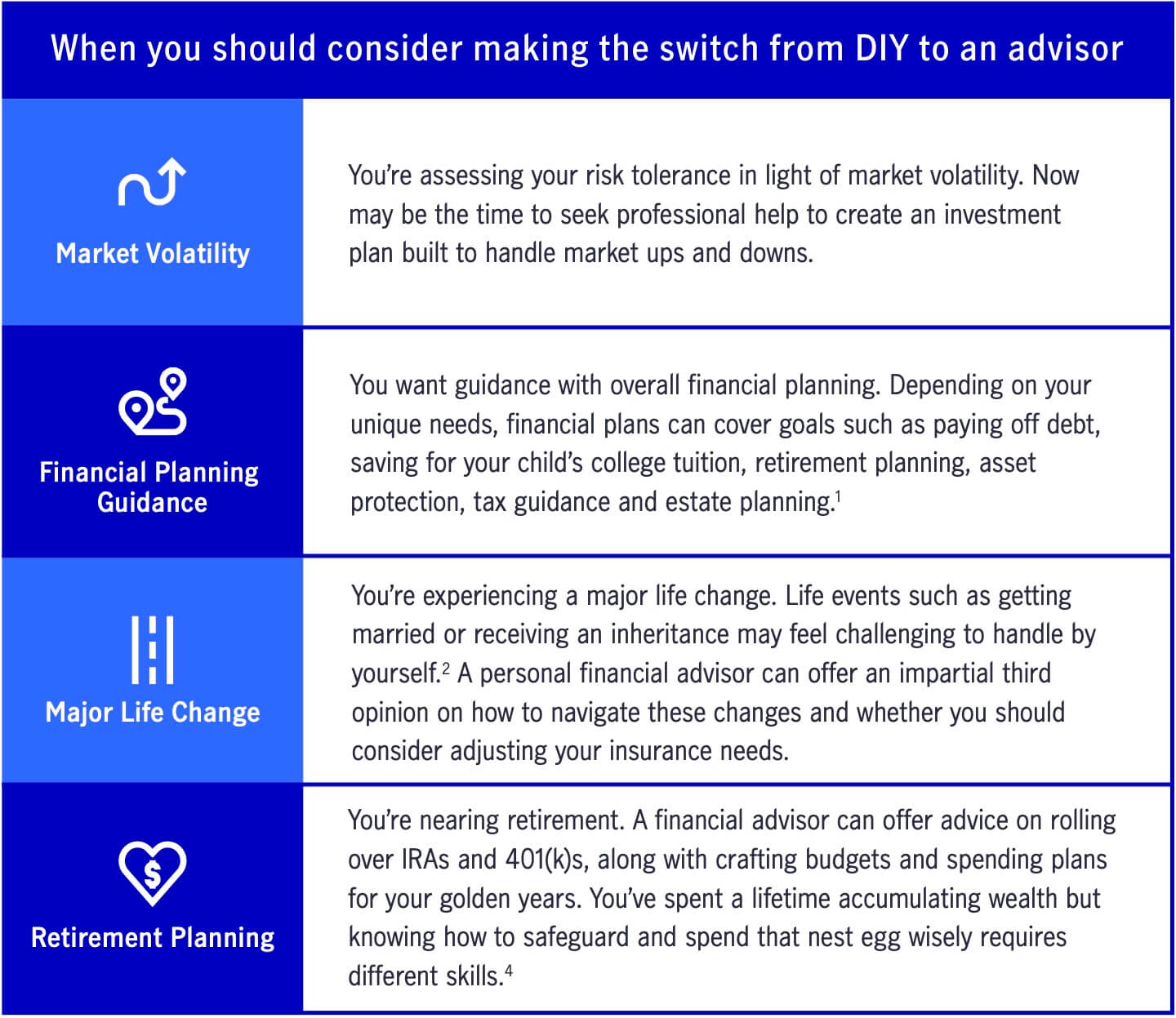

When your period is brief and your need to take out from your profile is high, you ought to not anticipate way too much to be bought stock exchange. Your advisor needs to have the understanding as well as experience to produce a strategy that is perfect for you. A great advisor will pay attention and also offer the suggestions that you require to hear, yet not always what you wish to hear, especially when you come to be emotional about your money during sharp market downturns, and also ensure you plainly recognize that the effects of attempting to offer stocks at their nadir may result in a psychological mistake.

9 Easy Facts About Investment Advisors Described

Paying for specialist suggestions can be especially practical as you start to relocate down view the backstretch toward retired life. While you might have accumulated an impressive portfolio, you require a totally various collection of abilities to tactically spend down that savings so that it lasts at the very least as long as you do. investment advisors.

For everyone that does not have the time, proficiency, or inclination to be the de facto economic advisor, employing a relied on professional to produce and preserve a detailed strategy can be a solid financial investment. investment advisors. If your advisor's explanations of what is click here now going on in your portfolio are too far over your head, you may not feel certain about the decisions you make.

Many people don't want to discover deep stock evaluation methods from their consultants or read the fund annual records, yet the very best advisors offer descriptions at a customer's degree to ensure that client truly gains from the consultant. Advisors can't guarantee to beat the markets, but they can provide alternative support to construct self-confidence, understanding, and loyalty.

Top Guidelines Of Investment Advisors

There are numerous factors to think about: How usually should you meet in the first year to get to recognize each various other and create your monetary strategy? An excellent monetary expert will certainly constantly make certain that you understand the following time you ought to be in communication. investment advisors.

Recognizing what to look for in a Financial Advisor will certainly aid you discover one to match your needs as well as aid you achieve your goals. Here are four attributes you intend to seek when determining whether an Economic Expert is appropriate for you: Your Financial Consultant exists to work with you.

Investment Advisors - The Facts

You don't want an advisor who just does what you tell them as they're not adding any type of worth to your plan. In addition, you don't desire an advisor concentrated just on marketing you an investment car simply so they can collect extra payments. A Financial Expert that deals with you will certainly supply advice as well as techniques, and outline the pros and disadvantages of various decisions based on your economic situation as well as the space between where you are as well as where you wish to be.

After evaluating your goals and establishing a technique, your advisor needs to lay the approach out for you as well as provide an in-depth explanation of exactly how this approach best aligns with the goals you have actually setand what, if any type of, costs you might sustain. Together, you should be able to concern an agreed-upon method to execute.

Your Monetary Expert needs to remain on top of investments, execute research study, and existing you with all the information you will certainly need to determine before asking you to dedicate to an adjustment. A plan developed for long-term success should withstand the need for immediate modifications, enhancements, as well as temporary volatility and also trends.

Investment Advisors for Beginners